#BALANCE A CHECKBOOK UPDATE#

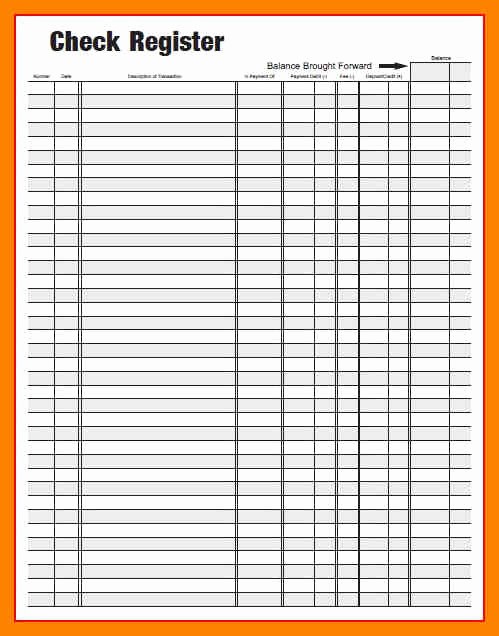

Update your balance in your checkbook register by keeping track of each withdrawal and deposit as they occur.Destroy voided or unused checks and deposit slips.Use restrictive endorsements, such as “For Deposit Only,” when appropriate.If you make a mistake on a check, write “VOID” across the check’s face, tear up the check, and write a new one.Write the check amount to the left of the amount line.Make sure the number and written words you write for the check amount match.Print the correct date on the check. Do not post-date a check.Record the transaction and update the balance after writing a check.Always check your balance to make sure you have enough money before writing a check.Endorsing a check means to sign the back of the check to make it “cashable.” For example, if you write a check to your friend, your friend would endorse the check to get the cash or the deposit the amount into his or her account. The back of the check has an endorsement area. There is also important information printed on the back of your checks: Routing and Account numbers. These numbers are helpful when setting up direct deposit or an automatic withdrawal/deposit.Your financial institution’s number and branch.The number is used to identify each check written. Your address and phone number are sometimes included. What is on the Check That You Will Need to Know Did you know that the line you sign on is actually micro-sized text that forms a line? This is one of many security features on a check. You can use this area to remind yourself why you wrote the check or to record the account number of the bill you are paying. This prevents anyone from adding an additional amount after what you have written. After writing out the amount of the check, draw a line to the end. The dollar amount of the check in words.The dollar amount of the check in numbers.This prevents anyone from adding an additional name on your check. After writing the name, you can draw a line to the end. This is where you write the name of the person or company to whom you will give the check. If I were making amazing money and had less debt I probably wouldn't do as much detailed tracking beyond my savings, retirement, and credit limits.To complete your checks, you will need to fill in the following pieces of information: This is ABSOLUTELY overkill, but I do it so that I'm always maintaining a sense of understanding my spending in the back of my brain, and it's worked great for the past handful of years. I put my paycheck days on the calendar too, and then regularly check my checking balance, and calculate what my monthly balance is going to be based on all the ins/outs, and put that number at the end of each month. I also have a google calendar with all of my monthly bills, their average (or high) amounts, and on which days they will be auto-drafted. I make sure to always have a "buffer" in my checking account at all times so I won't be caught by surprise. Poor folks and those that live paycheck to paycheck maybe, but my understanding is a lot of them lean heavily toward using cash which largely avoids these problems to begin with. I can understand how "when you spend money it takes time to process and fully complete before it reflects in your bank account" is still a thing, despite it maybe being faster than it used to be, but it's such a small issue now I can't fathom anyone needs to manually account for each dollar they spend with their debit/credit/checkbook to make sure when all those transactions complete they won't be in the negative.

0 kommentar(er)

0 kommentar(er)