- #Freelance bookkeeping bank statements only how to#

- #Freelance bookkeeping bank statements only software#

- #Freelance bookkeeping bank statements only professional#

As a self employed individual or freelancer, these tasks can often pile up as daily responsibilities and running your business take up the bulk of your time.ĭoing bookkeeping for self employed individuals includes tasks like: There are daily, weekly, monthly, quarterly, and annual tasks that should be completed for sound bookkeeping.

#Freelance bookkeeping bank statements only how to#

How To Do Bookkeeping for Self-Employedīookkeeping for self employed consists of managing expenses, invoicing, compiling documents, and managing cash flow for your business. We can help you set up your bookkeeping software, learn its functionalities and navigation, and find the best way to help keep you on track. We want to make it as easy as possible by handling the day to day. Keeping organized books can be difficult when you need to focus on running your business.

#Freelance bookkeeping bank statements only software#

This means you can access your data safely from any device at any time.Īt Accountor CPA, we listen to your financial goals and situation to determine the best bookkeeping software for self employed and freelancers to meet your needs and help you achieve your goals. The benefit of working with self employed bookkeeping software is that they are always cloud-based solutions.

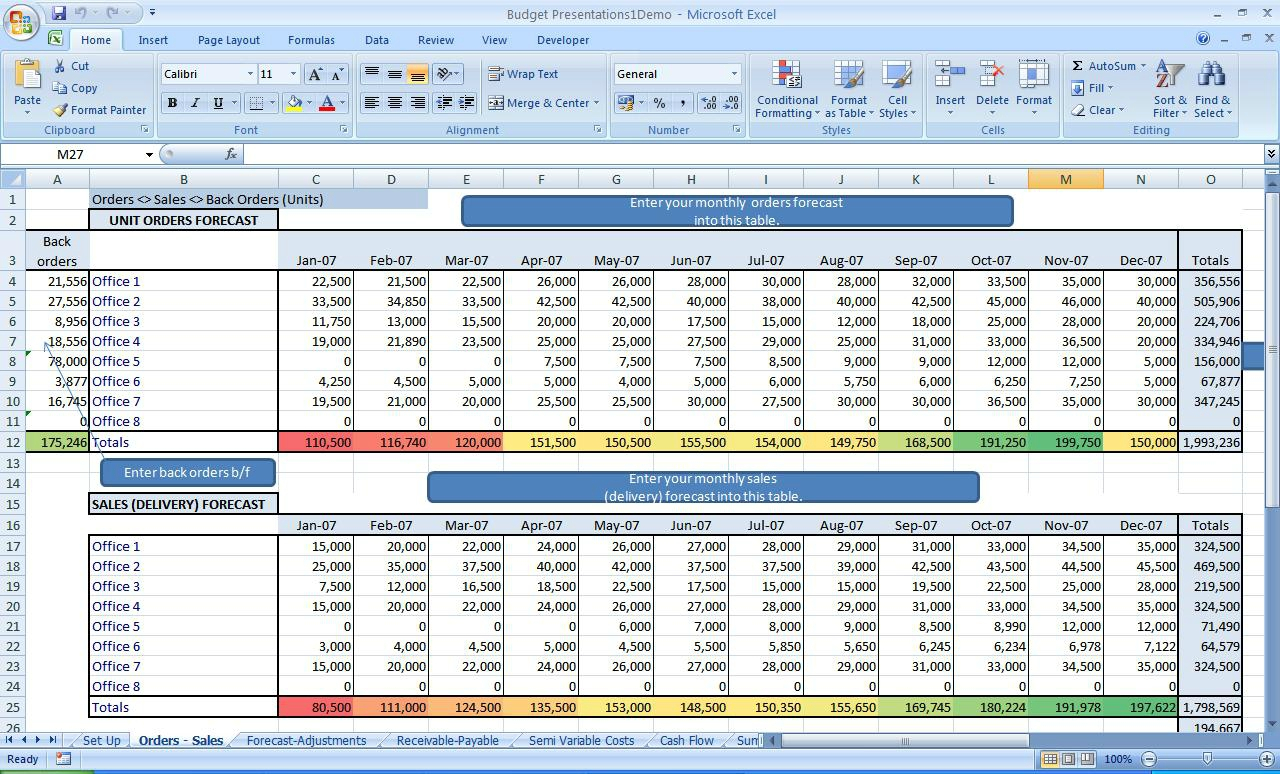

We understand the importance of this and make recommendations for bookkeeping apps and software based on these unique needs. QuickBooks Online and Xero in particular offer functions that allow for detailed expense tracking, automatic invoicing for clients, inventory management, project management, time tracking integrations, and have mobile app options for easily working on the go.įreelancers and self-employed individuals have unique expenses to track and need to have organized books for filing taxes upon year-end. Freelancers need many of the same bookkeeping functions as large corporations in their software - typically, much more than someone who is using bookkeeping software for only their personal or family use.Īt Accountor CPA, we use many types of bookkeeping software for self employed clients. While the scope of features available differs from software to software, self employed individual, independent contractors, and freelancers need robust bookkeeping capabilities to stay on top of their expenses, invoices, and cash flow. Some apps are suited more towards freelancers who need to track unique projects with different clients, while others are suited towards self-employed individuals with a different business model. These include:īut how do you know which one is right for your business?Īll self employed bookkeeping software comes with its own unique features, functions, and price tag. There are a number of self employed bookkeeping software programs and apps available. No two freelancers have the same work style, so no two freelancers will have the same needs from their bookkeeping software.

At Accountor CPA, part of our bookkeeping services is to help you find the bookkeeping software that suits your business, industry, and your lifestyle.

What are the best bookkeeping apps for self employed and freelancers? With so many options available, it can be difficult to choose one. Ready to get started? The Best Self-Employed Bookkeeping Software

#Freelance bookkeeping bank statements only professional#

Grow your brand and your reputation with professional bookkeeping for freelancers and self employed and the best bookkeeping software from Accountor CPA. We are dedicated to helping your business and career succeed and know the importance of professional bookkeeping to your operation. How can you decide what bookkeeping services and software are right for you?Īccountor CPA specializes in accounting and bookkeeping for companies in Canada, including self-employed individuals and freelancers. Freelancers need more robust features than bookkeeping for personal use or families, but not necessarily the advanced features that a large corporation would. With more and more people looking towards using their skills online with remote work, we can expect the needs of freelancers and self employed to grow even more in the coming years.īookkeeping for self employed and freelancers requires unique services and software functionalities. Self employed individuals and freelancers are a growing part of Canada’s business community.

0 kommentar(er)

0 kommentar(er)